The market for insurance companies is now expanding every day. And this is not surprising, because this area is extremely profitable. Insured events occur rarely, but payment from customers comes regularly. But not when it comes to hull or compulsory motor liability insurance. Cars constantly get into accidents, and the insurer has to pay for everything. It is at this moment that various unpleasant situations arise related to unscrupulous companies that are trying their best to avoid their obligations. You can influence them primarily through the courts, and for this you need to know how to make a claim to the insurance company.

Read the contract carefully

The most common reason for denying obligations to pay compensation is a violation of the terms of the contract by the applicant. Insurance companies go to all possible tricks so that the client is mistaken or violates the clause of the contract.

First of all, pay attention to the following points:

- The term for contacting the agent after the incident.

- The presence of malfunctions in the car before the accident.

- Necessary information to be provided.

Most conflicts with insurance companies arise due to a technical malfunction of the car. They can find fault with everything: a cracked headlight or the slightest malfunction of the radiator. Do not forget about the timely replacement of "shoes". Sometimes a violation of the timing of the replacement of rubber can cause a refusal to pay.

If you apply to the service station, be sure to save all the checks and immediately inform your insurance company. For your own good, do not be too lazy to carefully re-read the contract, clarify all the points even before its signing.

Next, we consider the main situations that can happen to you when you contact the agency, which is a reason for something to make a claim to the insurance company.

What to do if a payment is refused?

For example, you called your office after submitting an application to find out the result. They answered you standardly: "Your application has been examined, and, unfortunately, our company will not indemnify, in confirmation of this you will receive a document that you will find in the mailbox."

As soon as you hear this, do not waste time - go straight to the insurance company and find out why you were refused. They are obliged to indicate a significant reason, referring to the article of the law of the Russian Federation. In the event that the refusal sounds vague and unclear, then file a claim with the insurance company.

Another important nuance - do not be too lazy to require such documents: the certificate of inspection of the car by an insurance agent and confirmation of the acceptance of your certificates. These papers will succumb to you in the form of photocopied sheets certified by live print. They do not have the right to refuse. Act and declarations are necessary to write a claim to the insurance company in the future.

What if the payment amount does not cover repair costs?

Another turn of events is also possible. The company seems to have approved your application, but the compensation is so small that it is even partially unable to cover the cost of repairs. How to be To write a claim to the insurance company or not?

To begin with, you should personally go to the office of the company and ask for documents proving the established amount of compensation. This paper is called the calculation of the size of the cost of repairing the vehicle and is calculated by the agent. In addition to her, the company must provide an act on inspection of the owner’s car and an act on the occurrence of an insured event.

And only after that, on the basis of your figures with the service station and an independent examination of the cost of your repair, you can make a written claim.

What if the company is in no hurry to pay?

Officially, any insurance company has 31 days to transfer the approved amount to your account. If this does not happen, do not wait and do not hope for a miracle. Any decent company does not wait for the deadline, but transfers funds on time.

Therefore, feel free to write paper indicating all the nuances. A pre-trial claim with an insurance company is also forwarded to the Russian Union of Auto Insurers and the Federal Insurance Supervision Service.

The main content of the pre-trial claim

Consider what must be indicated on a piece of white paper. Please note that the claim form to the insurance company is exclusively written, not oral and is prepared in a free form according to a certain scheme.

- Describe the incident. If it is an accident - fully indicate the data of the cars involved in the accident, if the theft of the apartment - describe the property.

- Next, describe in detail exactly what your dissatisfaction is and what requirements you put forward to the insurance company.

- It is advisable to state your intentions in a separate paragraph, to threaten the company a little if it does not satisfy your requirements. For example, go to court.

Sometimes there are situations when a claim to an insurance company will be competently drawn up by a specialist. You will get a sample of it in your hands, but a professional knows better which paragraphs to describe and which laws of the Russian Federation to refer to.

When it comes to determining the amount of damage that is needed for repairs in the realities of modern life, then in this case you can not do without an independent examination. For example, you think that you were not paid extra for repairs. You call an expert who will conduct an inspection for a fee, analyze the costing received from the insurer, and based on these data, display your amount.

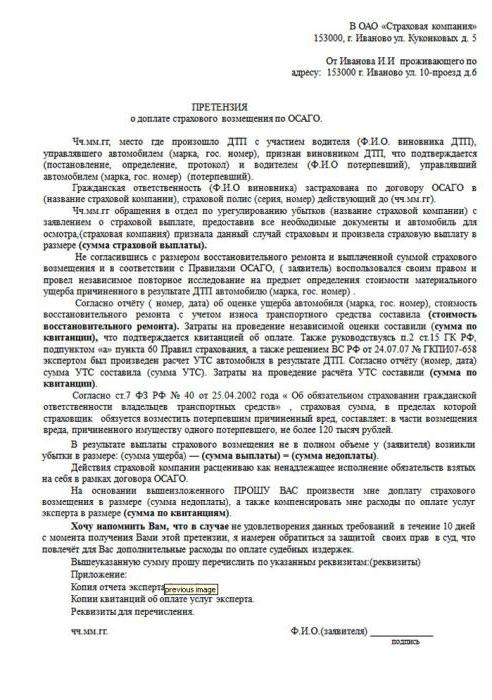

Claim to insurance company: sample

Consider the main points contained in the claim:

- Details of the parties.

- Body of the statement. First, it is indicated between whom and by whom the event occurred. Brands, car models, year of release, full name of owners are fully registered.

- It describes the circumstances of the accident and who was found guilty, and what rules were violated.

- The following paragraph indicates the names of the insurance companies of the parties. The numbers of policies and their validity are also registered.

- The following is a link to articles 15, 1064 and 931 of the Civil Code of the Russian Federation.

- After which it should be said that you, as the owner, suffered damage in the amount of such and such an amount, the amount of repair amounted to such and such an amount.

- The seventh paragraph indicates the requirement for the insurance company to pay the full amount.

- The last point is to articulate your serious intentions to go with the appeal to the highest authority, if the requirements are ignored.

- At the end of the day, month, year and personal signature.

A claim to the OSAGO insurance company is submitted personally to the insurance agent. Wait until he puts his signature and stamp with the date of acceptance of your document.

You can familiarize yourself with the sample claim below.

Documents that must be attached to the application

Basically, copies are submitted, except for one - damage deduction report. So the required copies are:

- about an accident;

- an administrative offense;

- receipt of remuneration for the work of an expert;

- vehicle registration certificates;

- Title

- identity documents, including driver’s license;

- bank account details;

- insurance policy number.

Duration of consideration

The law establishes that the insurance company has 5 working days to review your claim. After this time, you must report the decision. If the deadlines have been violated, you have the right to recover a fine in the amount of 0.05% of insurance amount calculated for the harm caused, for each day of the pending decision.