Recently, most consumers perceive insurance as an imposed service. However, banks everywhere continue to promote both their own insurance products and those belonging to partners. Of course, now the schemes have changed significantly. They are usually applied to legally weak borrowers who consider the insurance contract necessary and forced to make a choice - take what they give, or leave without money at all. How to apply for a waiver of insurance, every borrower should know.

However, there is another important factor that forces people to agree to insurance. The fact is that the loan conditions of the bank are often formed so that products with the inclusion of insurance seemed to the client more profitable at the interest rate, duration of the loan and the amount. The borrower thinks that he did not lose, but in reality the total amount of bank money, together with interest and insurance, is larger than that of a debt with higher interest, but without insurance, which is a typical marketing move that is very effective. We have to find out whether it is possible to refuse insurance after obtaining a loan, and if so, how.

Insurance law

More recently, when issuing a loan and signing an application for insurance, a person could hardly give a return move. Further appeals to the bank and the corresponding companies were marked by a categorical refusal: since the application was signed by the borrower himself, his action was deliberate and voluntary. Such a problem was solved in court, but only if a person could prove the fact of imposing a service.

Only a small number of financial institutions as an exception made it possible to issue a waiver of bank insurance and return money for it within a few days.

On June 1, 2016, the Bank of Russia, which also regulates the insurance market, made an announcement that citizens who bought the policy can return it and collect the money paid. For this, the so-called cooling period (five days) was introduced. During this period, the client could change his mind and contact the insurer, who is obliged to return the money to him. Legal return of insurance is carried out very quickly, the money is transferred to the applicant within ten days.

In addition to refusing insurance, the new law allows customers to disagree with various additional services that are imposed by the relevant organizations. However, in this case, the risk of a financial institution increases significantly. That is why banks increase interest rates or reserve the right to change them in the event of a client’s refusal. And such a path is prescribed in the loan agreement. This often stops borrowers from taking action. If the client does not agree to take out insurance, banks are reluctant to return the money to him. However, this is still real, even if the whole process is accompanied by a long debate with a financial institution.

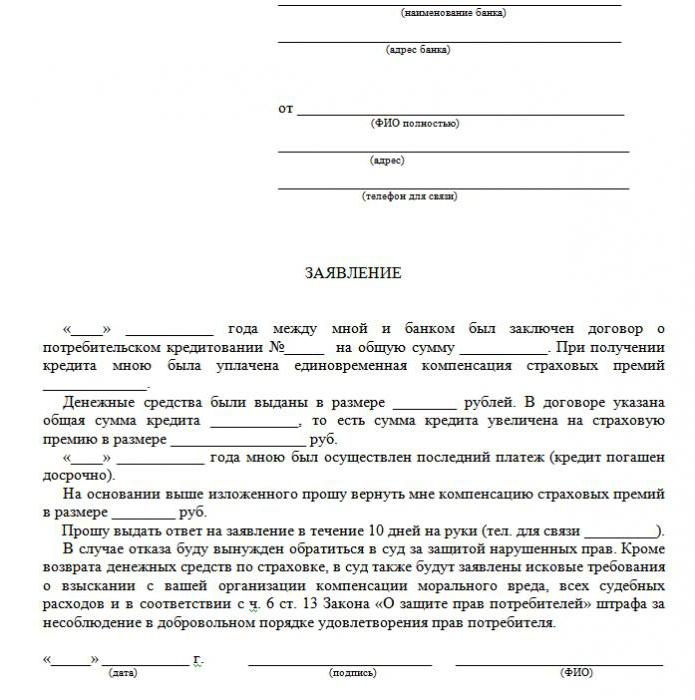

A sample of refusal of insurance on a loan is presented in the article.

What types of insurance are returned?

In the field of lending, there are both voluntary and mandatory types of insurance services, which include policies such as:

- Real estate insurance, relevant for a loan secured by real estate, mortgages, where the security should be protected.

- CASCO, when, when taking a car loan, the bank obliges the client to insure the purchased car - transport as a pledge gives the bank financial protection. So how do you make a refusal of insurance after receiving a loan? About it further.

All other types of services accompanying the conclusion of a loan agreement are voluntary.

Insurance can be returned for cash, commodity loans, credit cards, etc., which are accompanied by:

- customer life insurance;

- title insurance;

- a policy in case of reduction at work;

- protection against financial risks;

- borrower property insurance.

Insurance is legal in any case, as it is an additional service offered to the client upon conclusion of a loan agreement. If it is not included in the list of obligatory, the borrower can refuse it legally. True, such a choice will lead to a negative decision in issuing money. When a bank offers insurance, the law is in no way violated.

Can I refuse insurance?

You can apply for a cancellation of insurance, but it is not easy to do so. For their right to this action, some borrowers even sue creditors, but this option is not suitable for everyone, and the likelihood of losing is not canceled, since bank employees can easily turn the situation in their favor. At the same time, the client can ask his lender about whether it is possible to write an application for refusal of insurance on the loan several months after the completion of the contract and timely payments. But a similar procedure can be implemented only when a simple consumer loan is taken.

Subtleties in the law on the cooling period

A recent law does not affect collective bargaining agreements. It is valid only in case of concluding a contract of an individual and an insurance company. That is why banks often sell additional services as part of a collective agreement (in fact, the bank acts as an insurer), and it becomes impossible to return insurance during the cooling period.

Affordable Waivers

Many people think that insurance is a mandatory procedure when taking a loan. However, Russian law affirms the voluntary nature of the insurance contract. The catch is that a financial institution may refuse a loan even without indicating a reason.

Most often, customers are given the following alternative:

- Low interest rate program with compulsory insurance.

- Higher interest and lack of insurance.

Many are afraid that option number 2 is unprofitable. And therefore, they themselves agree to additional services unnecessary to them. But it often happens that higher interest rates are cheaper than payments under an insurance policy, which can be up to 30% of the total amount.

If the client chose the first path, he has the right to obtain a loan, and then legally issue a refusal of insurance (sample application below). When the application is approved by the bank and the contract is signed, the borrower may consider the payment of additional services unjustified and cancel.

Ways

There are two ways to refuse an insurance policy:

- by contacting the bank with a written request;

- through the court.

Also, a refusal can be issued in the event that within six months the loan was paid regularly. This requires the following actions:

Also, a refusal can be issued in the event that within six months the loan was paid regularly. This requires the following actions:

- Contact the credit department of the bank.

- Draw up a written request for termination of the insurance contract.

- Wait for a response from the bank.

In many cases, financial institutions respond positively to such requests from customers, if there are no delays in payments for the whole time and there are no insured events. Then the bank recounts interest rates and increases them to compensate for the risks.

A financial institution may recalculate only on the condition that it is provided for in the contract. Otherwise, the client will refuse his request.

Documents for going to court

If the bank did not go towards the borrower, it is possible to refuse credit insurance through the court. In order to file a lawsuit, the following documents are needed:

- loan agreement;

- insurance policy;

- bank refusal in writing.

Be sure to provide evidence of the imposition of insurance services, so it is better if all conversations with bank employees will be recorded on the recorder.In order to increase your chances of winning, it is advisable to enlist the support of a professional lawyer if the client is not competent in the legal subtleties.

The chances of winning a court are quite high: you just need to prove that the insurance policy was imposed by the bank by fraud (for example, inclusion in a monthly installment without warning). If a program with low interest and insurance was chosen voluntarily, it will be much more difficult to refuse.

Features of the refund of insurance contributions

The new legislation provides that the cancellation of credit insurance during the cooling period guarantees the return of money spent on the purchase of the insurance policy by the bank within ten days.

It is also possible to satisfy the client’s request in the absence of insurance during the cooling period. Since the policy is not always effective immediately after signing the contract, the amount of funds returned can be full and partial. If the insurance contract has not yet entered into force, the premium amount is fully refunded. Otherwise, the amount for the elapsed time is deducted from the funds, and the company has every right to do so, since the service was provided.

Features of returning insurance after a cooling period with an outstanding loan

If the cooling period has already passed, the design of the service does not fall under the new law. There is no need to rush to file a lawsuit to refuse insurance (many applications download a sample of the application on the Internet). Better try contacting your bank. Many organizations are now very loyal to customers and give them the opportunity to refuse additional services even later than five days later. This is how VTB 24 banks operate (under contracts that were executed before February 1, 2017), Home Credit, Sberbank (30 days).

If you send a claim to the organization, a refusal will almost completely come to it, justified by the fact that the client himself signed the application. In this case, the confident borrower can only go to court, and it is better to do this through lawyers who can suggest some loopholes. However, in reality it is very difficult to return the money, because the person himself agreed to the service and even paid for it.

Early repayment and insurance refund

Is it possible to return insurance if the loan is repaid ahead of schedule? Since the policy is drawn up for the loan repayment period, the person who repaid it completely ahead of schedule has the right to receive part of the insurance service fee. If the loan was taken for two years, and 60,000 rubles were paid for insurance, then in case of repayment in a year it is supposed to return 30,000 rubles. In general, this issue should be addressed to the bank.

An application for a refund is made either when an application for early repayment is written, or immediately after the loan is closed. To solve this issue, the bank can send the client directly to the insurance company. There he may request a sample application for refusal of insurance.

Act yourself or contact a lawyer?

If you return the insurance within five days prescribed by law, you will not need the help of a lawyer. But after this period, the process will become complicated and in some cases impossible. If the bank refuses, it is still worthwhile to seek qualified legal assistance, as the specialist will be more competent in this matter.

To avoid such delays and unplanned costs of hidden insurance, you need to carefully study each clause of the loan agreement, as some banks can take out the deduction of insurance premiums. Therefore, it is worth spending time studying the contract to avoid financial problems and litigation.

Then a sample application for canceling loan insurance is not needed.

Do you think today about how to get a legal loan?

Are you thinking of starting your own business?

Do you have any debts? Do you want to pay school fees?

Do you need an urgent loan to pay bills?

This is your chance to achieve your desires. We will help you with all types of loans.

Loans, business loans and student loans?

We provide a private loan of any kind

Loan with an interest rate of 2% for more information

Contact us by email {fhacyberservics@gmail.com}

INFORMATION FOR POSITIONS:

Credit amount:

Name of borrower:

Borrower's contact information:

You and the state:

City:

Nationality:

Loan Financing:

Duration of loan:

Civil Status:

Patch:

Floor:

Monthly income:

Email: fhacyberservics@gmail.com

Phone: +1903) 568-0039

Mr. Tony Rock

General consultant

The Armed Forces of the Russian Federation reminded banks that they should return money to borrowers who refused insurance

A citizen at the conclusion of the loan agreement announced his participation in the program of voluntary collective insurance against loss of work, accidents and illness of loan borrowers. Five days later, the borrower refused insurance and demanded the return of the money paid to the bank for insurance. The bank did not return the money - in the documents the parties agreed that the refusal of insurance is possible, but the payment for it is not refundable.

Considering this dispute, the Supreme Court recalled that all voluntary insurance contracts with individuals from March 2, 2016 must comply with the requirements of the Central Bank of the Russian Federation to the conditions and procedure for the implementation of certain types of voluntary insurance. At that time, these requirements provided for the return of the insurance premium in case the insured refused the insurance within five working days from the date of conclusion of the insurance contract (now this period has been increased to 14 calendar days).

In addition, the Armed Forces of the Russian Federation denied another argument not in favor of the borrower: lower courts noted that since the insurance contract is collective, the rights of the borrower as a consumer are not violated. And the bank acted as the insurer in this agreement - he concluded an insurance agreement in favor of citizens who joined the insurance program. And if so, then the requirements of the CBR are not applicable, since they apply only to individuals. However, the Supreme Court noted that since the property interest of the borrower was insured, it means that he is the insured.

Document: Determination of the Armed Forces of the Russian Federation of October 31, 2017 N 49-KG17-24

What do people do?